Clark Wealth Partners Can Be Fun For Everyone

Facts About Clark Wealth Partners Uncovered

Table of ContentsExamine This Report on Clark Wealth PartnersOur Clark Wealth Partners Statements6 Simple Techniques For Clark Wealth PartnersClark Wealth Partners Can Be Fun For EveryoneThe Clark Wealth Partners IdeasThe Only Guide for Clark Wealth PartnersThe Single Strategy To Use For Clark Wealth Partners

The world of financing is a complex one., for instance, lately found that virtually two-thirds of Americans were unable to pass a standard, five-question monetary proficiency test that quizzed individuals on subjects such as passion, financial obligation, and other relatively standard ideas.Along with managing their existing customers, monetary advisors will certainly often invest a reasonable amount of time weekly meeting with prospective customers and marketing their services to keep and expand their organization. For those thinking about becoming a financial expert, it is essential to take into consideration the average salary and task stability for those working in the field.

Programs in tax obligations, estate planning, investments, and threat management can be valuable for students on this path also. Depending upon your distinct occupation objectives, you may also need to gain specific licenses to meet specific customers' demands, such as acquiring and marketing stocks, bonds, and insurance plan. It can additionally be handy to make an accreditation such as a Certified Monetary Organizer (CFP), Chartered Financial Expert (CFA), or Personal Financial Professional (PFS).

Getting The Clark Wealth Partners To Work

Many individuals choose to obtain assistance by making use of the solutions of a monetary specialist. What that resembles can be a variety of things, and can differ depending on your age and stage of life. Before you do anything, research study is key. Some people stress that they need a particular quantity of cash to spend before they can obtain assist from a specialist.

The 4-Minute Rule for Clark Wealth Partners

If you have not had any experience with an economic expert, here's what to anticipate: They'll begin by offering a comprehensive analysis of where you stand with your properties, obligations and whether you're satisfying standards contrasted to your peers for financial savings and retirement. They'll assess short- and lasting goals. What's practical regarding this action is that it is customized for you.

You're young and functioning full-time, have an auto or two and there are student car loans to repay. Here are some feasible ideas to help: Establish great cost savings routines, pay off financial debt, set baseline objectives. Repay trainee fundings. Depending on your occupation, you may qualify to have component of your college funding forgoed.

More About Clark Wealth Partners

You can discuss the following best time for follow-up. Prior to you begin, inquire about pricing. Financial consultants normally have different rates of rates. Some have minimum possession levels and will certainly charge a charge normally several thousand dollars for developing and adjusting a plan, or they might bill a level cost.

You're looking in advance to your retired life and helping your kids with higher education and learning prices. An economic consultant can use guidance for those circumstances and more.

The Greatest Guide To Clark Wealth Partners

That could not be the most effective means to maintain building wide range, especially as you progress in your job. Arrange routine check-ins with your planner to fine-tune your strategy as required. Stabilizing cost savings for retirement and university expenses for your kids can be complicated. A monetary advisor can aid you prioritize.

Thinking of when you can retire and what post-retirement years might look like can generate problems regarding whether your retired life cost savings remain in line with your post-work plans, or if you have actually saved sufficient to leave a legacy. Aid your monetary professional comprehend your strategy to money. If you are extra conventional with conserving (and potential loss), their ideas should reply to your worries and concerns.

The Best Guide To Clark Wealth Partners

For instance, preparing for healthcare is just one of the large unknowns in retirement, and a financial professional can detail options and suggest whether extra insurance coverage as protection may be helpful. Before you start, try to get comfortable with the idea of sharing your entire financial picture with a specialist.

Providing your specialist a complete image can aid them produce a plan that's focused on to all components of your financial condition, especially as you're quick approaching your post-work years. If your financial resources are basic and you have a love for doing it yourself, you might be fine on your own.

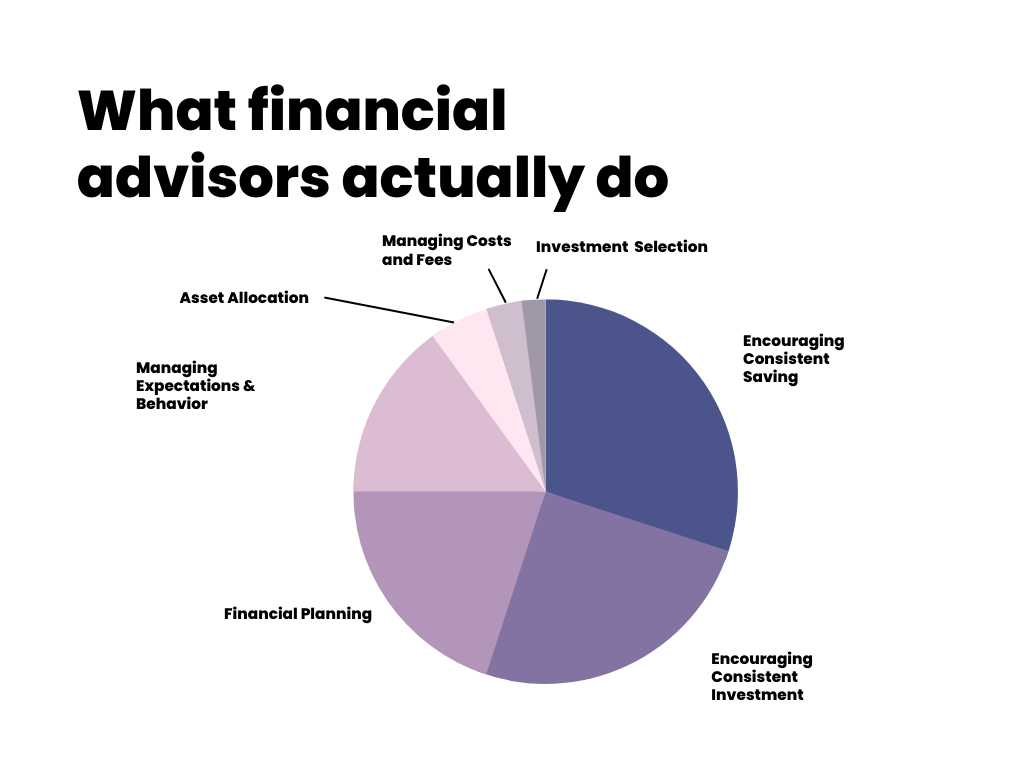

A financial advisor is not only for the super-rich; any person dealing click this with significant life shifts, nearing retirement, or sensation bewildered by economic choices could gain from professional support. This post discovers the role of monetary advisors, when you may need to get in touch with one, and vital considerations for selecting - https://site-nq446ewsn.godaddysites.com/f/why-choosing-the-right-financial-advisors-illinois-transforms-you. An economic advisor is a trained professional that assists customers handle their finances and make informed choices that align with their life goals

The smart Trick of Clark Wealth Partners That Nobody is Discussing

In comparison, commission-based consultants earn earnings via the monetary items they sell, which might affect their referrals. Whether it is marital relationship, separation, the birth of a child, career modifications, or the loss of a liked one, these events have special economic ramifications, typically requiring timely decisions that can have long-term impacts.